Hunter Biden News: A Comprehensive Overview

Hunter Biden, the son of President Joe Biden, has been a prominent figure in the news for various reasons. From business dealings to personal struggles, his life has been under intense public scrutiny.

This article aims to provide a detailed look at the latest news surrounding Hunter Biden, breaking down complex issues into understandable terms for the general public.

Introduction to Hunter Biden News

Hunter Biden has been a subject of interest and controversy for several years. From his business ventures to his personal life, he has been a frequent topic in the media. But who is Hunter Biden, and why is he often in the news?

Hunter Biden’s Background and Early Life

Born on February 4, 1970, Hunter Biden is the second son of Joe Biden, the 46th President of the United States. He grew up in a prominent political family and faced early tragedy when his mother and sister died in a car accident. Despite these challenges, Hunter pursued education and career opportunities, graduating from Georgetown University and Yale Law School.

Business Ventures and Controversies

Hunter Biden’s business dealings have been a significant focus of media attention. He has served on the boards of various companies, including the Ukrainian natural gas company Burisma. His involvement with Burisma, especially during his father’s vice presidency, has led to allegations of conflicts of interest and corruption. Critics argue that Hunter’s business activities were improper, while supporters claim there is no evidence of wrongdoing.

Legal Troubles and Investigations

Hunter Biden’s legal issues have added to his controversial image. In December 2020, he announced that the U.S. Attorney’s Office in Delaware was investigating his tax affairs. The investigation is reportedly focused on his foreign business dealings, including his work with Burisma. These legal challenges have fueled public debate about his actions and their implications.

Personal Struggles and Recovery

Hunter Biden has also faced personal struggles, particularly with addiction. He has been open about his battles with substance abuse, which have affected his personal and professional life. Hunter has sought treatment multiple times and has written about his journey to recovery in his memoir, “Beautiful Things.”

Impact on Joe Biden’s Presidency

Hunter Biden’s controversies have inevitably impacted his father’s presidency. Critics have used Hunter’s actions to question Joe Biden’s integrity and decision-making. Despite these challenges, Joe Biden has expressed unwavering support for his son, emphasizing the importance of family and resilience.

Media Coverage and Public Perception

Media coverage of Hunter Biden has been extensive and polarized. Some outlets focus on his business controversies, while others highlight his personal recovery story. Public perception of Hunter varies widely, influenced by political views and media narratives.

Hunter Biden’s Memoir: “Beautiful Things”

In 2021, Hunter Biden released his memoir, “Beautiful Things,” which offers a candid look at his life. The book delves into his struggles with addiction, his family’s tragedies, and his efforts to find redemption. “Beautiful Things” provides a personal perspective on the challenges Hunter has faced and his journey toward healing.

Future Prospects for Hunter Biden

What lies ahead for Hunter Biden? While his past continues to attract attention, he is working on rebuilding his life and focusing on his family. Hunter’s future will likely include continued scrutiny, but also opportunities for personal growth and contribution to society.

Frequently Asked Questions

1. Why is Hunter Biden often in the news?

Hunter Biden is frequently in the news due to his business dealings, legal troubles, and personal struggles, all of which are magnified by his father’s political prominence.

2. What is the Burisma controversy?

The Burisma controversy involves Hunter Biden’s role on the board of the Ukrainian natural gas company Burisma while his father was Vice President, raising concerns about potential conflicts of interest.

3. Is Hunter Biden still under investigation?

As of now, Hunter Biden is reportedly still under investigation by the U.S. Attorney’s Office in Delaware regarding his tax affairs and foreign business dealings.

4. How has Hunter Biden addressed his addiction issues?

Hunter Biden has openly discussed his battles with addiction, seeking treatment multiple times and sharing his experiences in his memoir, “Beautiful Things.”

5. How does Hunter Biden’s situation affect Joe Biden’s presidency?

Critics have used Hunter Biden’s controversies to question Joe Biden’s judgment and integrity, although Joe Biden continues to publicly support his son.

Conclusion

Hunter Biden’s life is a complex tapestry of successes, struggles, and controversies. From his early years in a prominent political family to his battles with addiction and legal issues, Hunter’s story is multifaceted.

As he navigates the challenges and opportunities ahead, public interest in his life shows no signs of waning.

Understanding Hunter Biden’s journey helps illuminate the broader context of his father’s presidency and the personal dynamics at play.

Understanding TSH Levels: A Comprehensive Guide

Have you ever heard your doctor mention TSH levels and wondered what they mean?

If you’re like many people, medical jargon can sometimes sound like a foreign language.

In this article, we’ll break down everything you need to know about TSH levels in a way that’s easy to understand.

Whether you’re trying to decode your latest lab results or want to learn more about how your thyroid functions, we’ve got you covered.

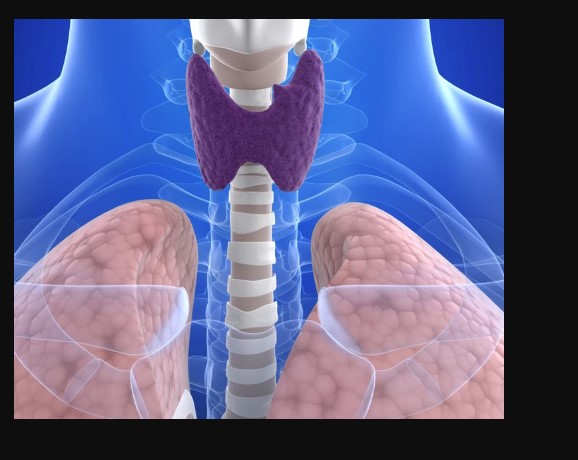

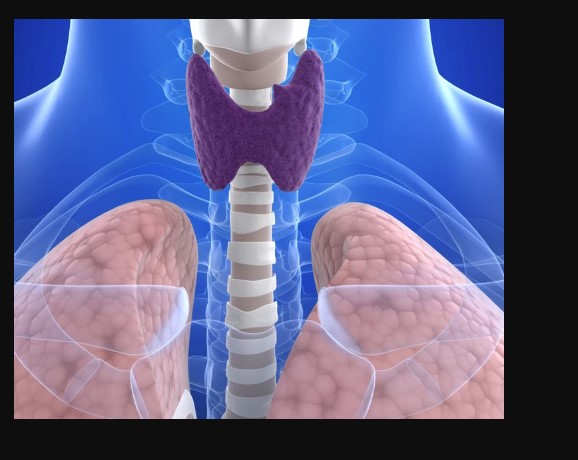

What is TSH?

TSH stands for Thyroid Stimulating Hormone. It’s a bit like a conductor in an orchestra, directing the thyroid gland on how much hormone to produce. Your thyroid, a small butterfly-shaped gland in your neck, plays a crucial role in regulating your metabolism, energy levels, and overall health. Produces TSH. The pituitary gland produces TSH and helps keep everything in balance.

How TSH Levels Affect Your Health

Think of TSH as a thermostat for your body. Just as a thermostat maintains the temperature in your home, TSH regulates the levels of thyroid hormones in your bloodstream. When TSH levels are out of balance, it can affect almost every aspect of your health, from your energy levels to your weight and even your mood.

Understanding Normal TSH Levels

What’s considered a “normal” TSH level? Generally, normal TSH levels range from 0.4 to 4.0 milliunits per litre (mU/L). However, what’s normal can vary slightly depending on the lab and individual factors such as age and pregnancy.

High TSH Levels: Causes and Symptoms

When your TSH levels are high, it usually means your thyroid is underactive, a condition known as hypothyroidism. Causes of high TSH levels include:

- Hashimoto’s Thyroiditis: An autoimmune condition where the body attacks the thyroid gland.

- Thyroid Surgery: Removal of part or all of the thyroid.

- Radiation Therapy: Treatment for cancer that affects the thyroid gland.

Symptoms of high TSH levels can include:

- Fatigue

- Weight gain

- Cold intolerance

- Dry skin

- Hair loss

Low TSH Levels: Causes and Symptoms

Low TSH levels typically indicate an overactive thyroid, known as hyperthyroidism. Causes of low TSH levels include:

- Graves’ Disease: An autoimmune disorder that leads to overactivity of the thyroid.

- Thyroid Nodules: Small lumps in the thyroid that produce excess hormones.

- Excessive Iodine Intake: Consuming too much iodine can overstimulate the thyroid.

Symptoms of low TSH levels can include:

- Weight loss

- Anxiety

- Tremors

- Increased heart rate

- Heat intolerance

How to Test Your TSH Levels

Testing your TSH levels is a simple process involving a blood test. Your doctor will draw a small sample of blood, usually from your arm, and send it to a lab for analysis. It’s best to take the test in the morning when TSH levels are typically highest.

Interpreting Your TSH Test Results

When you receive your TSH test results, you’ll see a number that represents your TSH level. Here’s a quick guide to help interpret those results:

- Normal TSH: 0.4 – 4.0 mU/L

- High TSH: Above 4.0 mU/L (may indicate hypothyroidism)

- Low TSH: Below 0.4 mU/L (may indicate hyperthyroidism)

It’s important to discuss your results with your doctor, who can provide more context and recommend the following steps if necessary.

Treatment Options for Abnormal TSH Levels

If your TSH levels are abnormal, don’t worry—there are effective treatments available. For high TSH levels, treatment might include the following:

- Thyroid Hormone Replacement Therapy: Taking synthetic thyroid hormones to restore balance.

- Dietary Adjustments: Ensuring adequate intake of iodine and other nutrients.

For low TSH levels, treatment options can include:

- Anti-thyroid Medications: Medications that reduce the production of thyroid hormones.

- Radioactive Iodine Therapy: Reducing thyroid hormone production by shrinking the thyroid gland.

- Surgery: In severe cases, part or all of the thyroid gland may be removed.

Lifestyle Changes to Support Healthy TSH Levels

In addition to medical treatments, specific lifestyle changes can help maintain healthy TSH levels:

- Balanced Diet: Eating a diet rich in fruits, vegetables, lean proteins, and whole grains can support thyroid health.

- Regular Exercise: Physical activity helps regulate metabolism and supports overall well-being.

- Stress Management: Techniques like meditation, yoga, and deep breathing can help reduce stress, which can impact thyroid function.

FAQs About TSH Levels

1. Can stress affect my TSH levels?

Yes, stress can impact your TSH levels. Chronic stress can affect the pituitary gland’s function and, subsequently, the production of TSH.

2. Are there any foods I should avoid if I have abnormal TSH levels?

Certain foods, such as those high in iodine (like seaweed), can affect thyroid function. It’s best to discuss dietary restrictions with your healthcare provider.

3. How often should I test my TSH levels?

The frequency of TSH testing depends on your health situation. If you’re on thyroid medication, your doctor may recommend testing every 6-12 months.

4. Can exercise help regulate TSH levels?

Yes, regular exercise can help maintain healthy TSH levels by supporting overall metabolic function and reducing stress.

5. Is it possible for TSH levels to return to normal without medication?

In some cases, lifestyle changes and addressing underlying health issues can help normalize TSH levels without medication. However, this should be done under the guidance of a healthcare provider.

Conclusion

Understanding your TSH levels is critical to managing your thyroid health and overall well-being. Whether your levels are high, low, or within the normal range, being informed can help you make better health decisions.

If you have any concerns about your TSH levels, don’t hesitate to reach out to your healthcare provider for personalized advice and treatment options.

Semaglutide Weight Loss: Everything You Need to Know

Are you tired of trying countless diets and weight loss programs without seeing the results you desire?

If so, you’re not alone. Many people are searching for practical solutions to shed those extra pounds and achieve a healthier lifestyle. One promising option gaining attention is semaglutide.

In this article, we’ll delve into the details of semaglutide for weight loss, exploring how it works, its benefits, potential side effects, and much more.

Introduction to Semaglutide

Semaglutide is a medication initially developed to treat type 2 diabetes. However, recent studies have shown that it can also be highly effective for weight loss. Imagine a key that unlocks your body’s potential to lose weight—that’s essentially what semaglutide does.

It helps regulate your appetite and energy intake, making it easier for you to stick to a healthy diet and lose weight.

How Semaglutide Works

So, how does this “magic key” work? Semaglutide mimics a hormone in your body called GLP-1 (glucagon-like peptide-1). This hormone is involved in regulating your appetite, making you feel full, and controlling blood sugar levels.

By activating GLP-1 receptors, semaglutide helps you eat less and feel satisfied sooner, which can lead to significant weight loss over time.

The Science Behind Semaglutide

The science behind semaglutide is fascinating. GLP-1 is a naturally occurring hormone that plays a crucial role in maintaining energy balance and glucose metabolism.

When you eat, GLP-1 is released from the intestines and signals your brain to reduce hunger and slow down stomach emptying. Semaglutide enhances these effects, helping you feel fuller for more extended periods and reducing your overall calorie intake.

Benefits of Semaglutide for Weight Loss

What makes semaglutide stand out in the crowded field of weight loss solutions? Here are some key benefits:

- Effective Weight Loss: Clinical trials have shown that semaglutide can lead to significant weight loss, often more than other medications or lifestyle interventions.

- Improved Metabolic Health: In addition to weight loss, semaglutide helps improve blood sugar control and reduces the risk of cardiovascular diseases.

- Sustained Results: Many people who use semaglutide experience long-term weight maintenance, which is often the most challenging part of any weight loss journey.

Potential Side Effects and Risks

Like any medication, semaglutide comes with potential side effects. It’s essential to be aware of these before starting treatment. Common side effects include:

- Nausea

- Diarrhea

- Vomiting

- Constipation

Most side effects are mild and tend to diminish over time as your body adjusts to the medication. However, it’s crucial to discuss any concerns with your healthcare provider to ensure semaglutide is the right choice for you.

Who Can Benefit from Semaglutide?

Semaglutide is typically prescribed for adults with a body mass index (BMI) of 30 or higher or those with a BMI of 27 or higher who have weight-related health issues such as high blood pressure, type 2 diabetes, or high cholesterol. If you’ve struggled with weight loss through diet and exercise alone, semaglutide may offer the help you need to reach your goals.

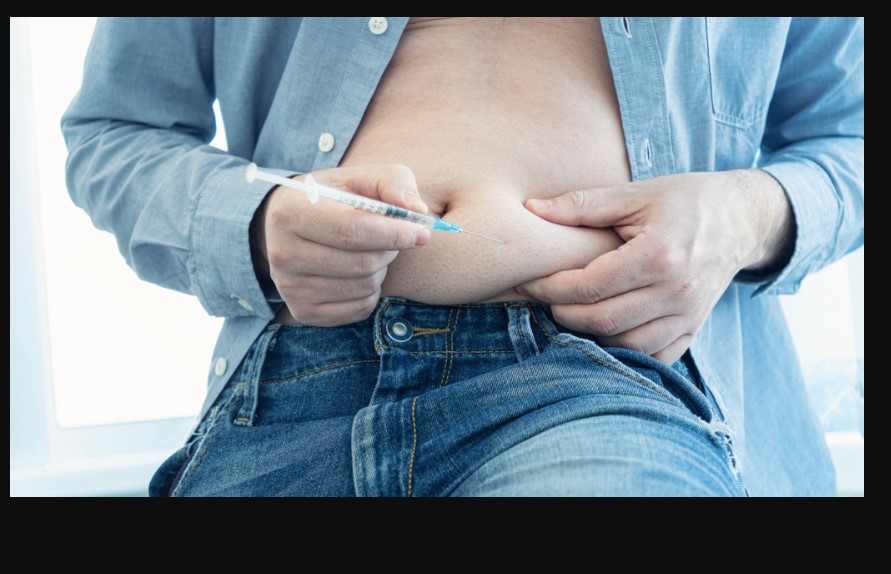

How to Take Semaglutide

Semaglutide is administered via a weekly injection, making it a convenient option for many people. Your healthcare provider will guide you on how to properly administer the injections and adjust the dosage as needed based on your progress and any side effects you experience.

Semaglutide vs. Other Weight Loss Medications

There are several weight loss medications available, but semaglutide stands out for several reasons:

- Efficacy: Studies have shown that semaglutide often results in more significant weight loss compared to other medications.

- Mechanism of Action: Unlike appetite suppressants, semaglutide works by regulating hunger hormones, leading to more natural and sustained weight loss.

- Additional Health Benefits: Semaglutide also improves blood sugar control and reduces the risk of heart disease, making it a more comprehensive solution for overall health.

Success Stories and Testimonials

Hearing from others who have successfully used semaglutide can be incredibly motivating. Here are a few success stories from individuals who have transformed their lives with the help of semaglutide:

- Jane D.: “After struggling with my weight for years, semaglutide helped me lose 40 pounds in six months. I feel healthier and more energetic than ever before.”

- Mark R.: “Semaglutide was a game-changer for me. Not only did I lose 30 pounds, but my blood sugar levels are now under control. I can’t recommend it enough.”

Frequently Asked Questions

1. How long does it take to see results with semaglutide?

Most people start to see weight loss results within the first few weeks of starting semaglutide. However, individual results may vary, and it’s essential to follow your healthcare provider’s guidance for the best outcome.

2. Can I use semaglutide if I don’t have diabetes?

Yes, semaglutide is approved for weight loss in individuals without diabetes, provided they meet the criteria for BMI and weight-related health conditions.

3. What happens if I miss a dose?

If you miss a dose, take it as soon as you remember. If it’s close to your next scheduled dose, skip the missed dose and resume your regular dosing schedule. Do not take two doses at the same time.

4. Are there any dietary restrictions while taking semaglutide?

There are no specific dietary restrictions, but it’s advisable to follow a balanced, healthy diet to maximize the weight loss benefits of semaglutide.

5. Is semaglutide covered by insurance?

Coverage for semaglutide can vary depending on your insurance plan. It’s best to check with your insurance provider to understand your coverage and potential out-of-pocket costs.

Conclusion

Semaglutide represents a promising advancement in the field of weight loss medications. By mimicking a natural hormone that regulates appetite and blood sugar levels, it offers a unique and effective solution for individuals struggling to lose weight.

If you’re considering semaglutide, consult with your healthcare provider to determine if it’s the right option for you.

With the right guidance and commitment, semaglutide could be the key to unlocking your weight loss potential and achieving a healthier, happier you.

Enhance Your Shower Experience with the Isla Teak Shower Stool

Transforming your daily shower routine into a luxurious experience doesn’t always require a complete bathroom renovation. Sometimes, all it takes is the addition of a simple yet elegant accessory like the Isla Teak Shower Stool.

Crafted with both functionality and style in mind, teak shower stooloffers a multitude of benefits that can elevate your bathing experience to new heights.

The Beauty of Teak Wood

One of the standout features of the Isla Teak Shower Stool is its construction from high-quality teak wood. Known for its durability, resistance to moisture, and stunning natural aesthetics, teak wood is the perfect choice for bathroom furniture. Its inherent water-resistant properties make it ideal for use in the shower, ensuring longevity and minimal maintenance requirements.

Functional Design

The design of the Isla Teak Shower Stool is as practical as it is visually appealing. Its compact size allows it to fit seamlessly into most shower spaces without taking up excess room. The stool’s sturdy construction can support individuals of varying sizes, providing a stable and secure seating option for users.

Versatility

While primarily designed for use in the shower, the Isla Teak Shower Stool is a versatile piece of furniture that can serve multiple purposes throughout your home. Beyond the bathroom, it can be utilized as a stylish accent piece in your living room, bedroom, or outdoor patio area. Its sleek design and natural finish make it a welcome addition to any space.

Comfort and Support

Comfort is key when it comes to bathroom accessories, and the Isla Teak Shower Stool delivers in this regard. Its ergonomic design ensures optimal comfort during use, allowing you to relax and enjoy your shower to the fullest. The smooth surface of the teak wood prevents any discomfort often associated with sitting on hard surfaces, while the slatted design promotes airflow and prevents water pooling.

Safety Features

Safety should always be a top priority, especially in wet environments like the bathroom. The Isla Teak Shower Stool is equipped with non-slip rubber feet, providing stability and preventing the stool from sliding around on wet surfaces. This feature offers peace of mind, particularly for individuals with mobility issues or those who require extra support while bathing.

Easy Maintenance

Maintaining the Isla Teak Shower Stool is a breeze, thanks to its durable construction and water-resistant properties. Simply wipe it down with a damp cloth after each use to remove any soap residue or water droplets. Periodically treating the teak wood with a specialized oil will help preserve its natural beauty and protect it from moisture damage over time.

Environmental Sustainability

In addition to its functional benefits, the Isla Teak Shower Stool is also an environmentally friendly choice. Teak wood is harvested from sustainable plantations, ensuring that no natural habitats are depleted in the process. By opting for eco-friendly products like the Isla Teak Shower Stool, you can minimize your environmental footprint while still enjoying the luxury and beauty of natural materials.

Enhancing Your Bathroom Aesthetic

Beyond its practical benefits, the Isla Teak Shower Stool can also enhance the overall aesthetic of your bathroom. Its warm tones and timeless design add a touch of sophistication to any space, complementing a wide range of interior styles from modern to rustic. Pair it with coordinating teak accessories, such as shower caddies or towel racks, to create a cohesive and inviting atmosphere.

Conclusion

With its durable construction, functional design, and timeless aesthetic, the Isla Teak Shower Stool is a must-have accessory for any bathroom. Whether you’re looking to add a touch of luxury to your daily routine or simply seeking a practical seating solution, this versatile stool has you covered. Invest in the Isla Teak Shower Stool today and elevate your shower experience to new heights of comfort and style.

Revolutionizing Green Walls: The Rise of Synthetic Foliage

In recent years, the concept of green walls has gained immense popularity as a means to bring nature into urban spaces while providing numerous benefits, including improved air quality, enhanced aesthetics, and biodiversity support.

However, the maintenance challenges and limitations associated with natural plants have led to the emergence of a new trend: synthetic foliage for green walls. This article explores the growing popularity and benefits of artificial foliage specially designed for green walls, offering a sustainable and low-maintenance alternative to traditional plant-based solutions.

The Evolution of Green Walls

Green walls, also known as living walls or vertical gardens, have a rich history dating back to ancient civilizations like the Babylonians and the Romans, who incorporated vegetation into architectural structures. However, modern green walls have evolved significantly, driven by advancements in technology and sustainability practices. Today, green walls are prized for their ability to mitigate urban heat island effects, reduce energy consumption, and create inviting outdoor spaces in densely populated areas.

The Challenges of Natural Green Walls

While natural plants offer undeniable beauty and environmental benefits, maintaining green walls with living vegetation presents numerous challenges. Factors such as irrigation requirements, soil composition, sunlight exposure, and pest control can be complex and time-consuming, particularly in indoor or urban environments with limited space and resources. Additionally, natural green walls may require frequent pruning, watering, and replanting to maintain their appearance and vitality, posing logistical and cost-related challenges for property owners and landscape designers.

Introducing Synthetic Foliage for Green Walls

In response to the limitations of natural green walls, synthetic foliage has emerged as a viable alternative that offers the visual appeal of living plants without the maintenance requirements. Synthetic foliage is made from high-quality materials such as polyethylene, polyethylene terephthalate (PET), or polyvinyl chloride (PVC), engineered to replicate the texture, color, and appearance of real foliage with remarkable realism. These artificial plants are UV-resistant, weatherproof, and durable, making them suitable for both indoor and outdoor applications.

Benefits of Synthetic Foliage for Green Walls

- Low Maintenance: One of the primary advantages of synthetic foliage for green walls is its minimal maintenance requirements. Unlike natural plants, artificial foliage does not require watering, fertilization, or pruning, allowing property owners and landscape designers to save time and resources while still enjoying the aesthetic benefits of green walls.

- Longevity: Synthetic foliage is designed to withstand the elements, including harsh sunlight, heavy rain, and temperature fluctuations, without fading or deteriorating over time. This longevity ensures that green walls maintain their visual appeal and structural integrity for years to come, offering a cost-effective solution for sustainable landscaping.

- Versatility: Synthetic foliage offers unparalleled versatility in design and installation, allowing for customizable green wall solutions tailored to specific aesthetic preferences and spatial constraints. Artificial plants come in a variety of sizes, shapes, and colors, enabling creative expression and architectural integration in diverse indoor and outdoor environments.

- Sustainability: While natural green walls require ongoing resources for maintenance and upkeep, synthetic foliage offers a sustainable alternative that conserves water, reduces chemical usage, and minimizes carbon emissions associated with transportation and disposal. By choosing artificial plants for green walls, individuals and organizations can contribute to environmental conservation efforts while enhancing the beauty of their surroundings.

Applications of Synthetic Foliage

Synthetic foliage for green walls has a wide range of applications across various sectors, including:

- Commercial and residential buildings

- Hospitality venues (hotels, restaurants, resorts)

- Retail spaces (shopping malls, boutiques, storefronts)

- Educational institutions (schools, universities, libraries)

- Healthcare facilities (hospitals, clinics, wellness centers)

- Public spaces (parks, plazas, transportation hubs)

Whether used as decorative accents, privacy screens, or architectural features, synthetic foliage offers endless possibilities for enhancing indoor and outdoor environments with lush greenery.

Conclusion

As the demand for sustainable and low-maintenance landscaping solutions continues to grow, synthetic foliage for green walls has emerged as a transformative innovation in the field of urban design and environmental stewardship.

By combining the visual beauty of nature with the practical benefits of artificial materials, synthetic foliage offers a compelling alternative to traditional green walls, enabling individuals and organizations to create vibrant and sustainable spaces that inspire and delight for years to come.

Siam Commercial Bank (SCB): A Comprehensive Guide

Siam Commercial Bank (SCB) is one of Thailand’s most influential and longstanding financial institutions.

This article provides an in-depth look into SCB, its history, services, and its impact on the banking sector in Thailand.

Designed for readers seeking valuable insights, the content is straightforward, easy to read, and optimized for search engines.

Introduction To Siam Commercial Bank (SCB)

Siam Commercial Bank, often abbreviated as SCB, is a cornerstone of Thailand’s banking industry. Established over a century ago, SCB has become a leading financial institution, offering various services to individuals and businesses. This article explores the essential aspects of SCB, providing valuable information to readers.

History of Siam Commercial Bank

Founding and Early Years

- Establishment: SCB was founded in 1906 by Prince Mahisorn, marking it as the first bank in Thailand.

- Initial Role: The bank initially focused on providing financial services to support the growing trade between Thailand and other countries.

Major Milestones

- Stock Exchange Listing: SCB was listed on the Thailand Stock Exchange in 1976.

- Digital Transformation: In recent years, SCB has embraced digital banking, launching innovative services to meet modern customer needs.

Key Services Offered by SCB

Personal Banking

- Savings and Checking Accounts: Wide range of account options to suit different customer needs.

- Loans and Mortgages: Competitive rates for personal loans and home mortgages.

- Credit Cards: Various credit card options with attractive benefits and rewards.

Business Banking

- Corporate Loans: Tailored financing solutions for businesses of all sizes.

- Trade Finance: Services to facilitate international trade and business expansion.

- Cash Management: Efficient solutions for managing company finances.

Wealth Management

- Investment Services: Personalized investment advice and portfolio management.

- Estate Planning: Comprehensive services to manage and preserve wealth for future generations.

Digital Banking

- Mobile Banking: User-friendly app offering a range of banking services.

- Internet Banking: Secure and convenient online banking platform.

- SCB PromptPay: Seamless money transfers using mobile numbers or Citizen IDs.

Branch Network and Global Presence

Domestic Network

- Extensive Coverage: Hundreds of branches across Thailand ensure easy access to banking services.

International Operations

- Global Reach: Presence in key international markets like Hong Kong, Singapore, and Myanmar, supporting cross-border financial needs.

SCB’s Business Model

Revenue Streams

- Interest Income: Major revenue from loans and mortgages.

- Service Fees: Income from banking services and transaction fees.

- Investment Profits: Earnings from investments and financial market activities.

Strategic Partnerships

- Fintech Collaborations: Partnerships with technology companies to enhance service offerings.

- Global Alliances: Collaborations with international banks and financial institutions.

Customer-Centric Approach

- Feedback Mechanisms: Regular customer feedback to improve services.

- Personalized Services: Tailored banking solutions to meet individual customer needs.

Technology and Innovation

Digital Transformation

- AI and Big Data: Utilizing advanced technologies for better customer service and operational efficiency.

- Blockchain Technology: Implementing blockchain for secure and transparent transactions.

Mobile and Online Banking

- Mobile App Features: Real-time transaction alerts, secure login, and easy fund transfers.

- Online Banking: A comprehensive range of services available 24/7 through a secure online platform.

Sustainability and CSR Initiatives

Environmental Impact

- Green Financing: Promoting loans and projects that support environmental sustainability.

- Energy Efficiency: Initiatives to reduce the bank’s carbon footprint.

Social Responsibility Programs

- Educational Support: Scholarships and educational programs for underprivileged students.

- Community Development: Projects aimed at improving healthcare and economic opportunities in local communities.

Governance Practices

- Ethical Standards: Strong commitment to ethical banking practices and corporate governance.

- Transparency: Clear and transparent reporting to stakeholders.

Financial Performance

Annual Reports

- Detailed Insights: Comprehensive financial reports available to the public.

- Performance Metrics: Key indicators include net interest margin, return on equity, and cost-to-income ratio.

Market Position

- Leading Bank: Strong market presence and significant share in Thailand’s banking sector.

- Financial Stability: Robust financial health supported by diverse revenue streams.

Customer Experience

Service Quality

- High Standards: Commitment to providing high-quality banking services.

- Customer Feedback: Regularly collected and acted upon to improve service quality.

Customer Support

- 24/7 Assistance: Round-the-clock support through various channels.

- Multilingual Support: Services available in multiple languages to cater to a diverse customer base.

Feedback and Reviews

- Continuous Improvement: Using feedback to enhance services and address customer concerns.

- Positive Reviews: High customer satisfaction is reflected in positive reviews and ratings.

Challenges and Opportunities

Regulatory Compliance

- Adhering to Laws: Ensuring compliance with domestic and international banking regulations.

- Navigating Changes: Adapting to regulatory changes and maintaining compliance.

Competitive Landscape

- Market Competition: Staying ahead in a highly competitive banking industry.

- Innovation and Differentiation: Leveraging technology and customer service to differentiate from competitors.

Future Growth Prospects

- Digital Expansion: Further expanding digital services and capabilities.

- New Markets: Exploring opportunities in emerging markets.

Risk Management

Risk Assessment Strategies

- Identifying Risks: Comprehensive risk assessment processes.

- Mitigation Plans: Implementing strategies to mitigate identified risks.

Compliance with Global Standards

- Global Frameworks: Adhering to international risk management standards.

- Best Practices: Implementing best practices in risk management.

Corporate Culture

Values and Mission

- Core Values: Integrity, customer focus, and innovation.

- Mission Statement: Committed to driving commerce and prosperity.

Employee Engagement

- Training and Development: Programs to enhance employee skills and satisfaction.

- Employee Well-being: Initiatives to promote a healthy and productive work environment.

Diversity and Inclusion

- Inclusive Policies: Commitment to diversity and inclusion in the workplace.

- Equal Opportunities: Ensuring equal opportunities for all employees.

Case Studies

Successful Client Stories

- Real-Life Examples: Clients who have benefited from SCB’s services.

- Impactful Solutions: How SCB’s tailored solutions have helped clients achieve their goals.

Innovation in Action

- Technological Implementations: Examples of successful technology integrations.

- Operational Efficiency: Enhancements in efficiency through innovative solutions.

Market Expansion Efforts

- New Markets: Efforts to expand into new geographical markets.

- Strategic Growth: Strategies for sustainable growth and market penetration.

Expert Opinions

Insights from Financial Analysts

- Analyst Reports: Evaluations of SCB’s financial health and strategic direction.

- Market Analysis: Insights into market trends and SCB’s positioning.

Industry Leader Interviews

- Leadership Perspectives: Interviews with SCB’s top executives.

- Strategic Vision: Leaders’ views on the future of the banking industry.

Market Predictions

- Future Trends: Predictions of banking and SCB’s role.

- Growth Opportunities: Areas of potential growth for SCB.

Future Outlook

Emerging Trends

- Fintech Innovations: Embracing fintech to stay competitive.

- Sustainability Focus: Increased focus on sustainable banking practices.

Strategic Goals

- Customer Experience: Enhancing customer experience through innovation.

- Global Expansion: Expanding presence in international markets.

Long-Term Vision

- Leading Bank: Aiming to be the leading bank in Southeast Asia.

- Prosperity Driver: Driving commerce and prosperity through innovative banking solutions.

Conclusion

Siam Commercial Bank remains a vital player in Thailand’s financial sector. It offers a wide range of services and embraces innovation to meet modern banking needs.

With a strong commitment to customer satisfaction, sustainability, and ethical practices, SCB is well-positioned to continue its legacy of excellence.

As the bank evolves, it aims to lead in driving commerce and prosperity in Thailand and beyond.

FAQs

What is Siam Commercial Bank (SCB)?

Siam Commercial Bank (SCB) is a leading financial institution in Thailand that offers a wide range of banking and financial services.

How can I open an account with SCB?

You can open an account with SCB by visiting their website or a local branch, providing the necessary identification documents, and completing the application process.

What are the main services offered by SCB?

SCB offers personal, business, wealth management, and digital banking solutions.

How does SCB contribute to sustainability?

SCB promotes sustainability through green financing, social responsibility programs, and ethical governance practices.

What are the plans for SCB?

SCB plans to expand its digital services, enter new markets, and continue leveraging technology for innovation and customer satisfaction.

The Ultimate Guide to ไทยพาณิชย์ (Siam Commercial Bank): Your Financial Partner in Thailand

Are you looking for a reliable banking partner in Thailand?

Look no further than ไทยพาณิชย์, also known as Siam Commercial Bank (SCB). As one of Thailand’s leading financial institutions, SCB offers a wide range of banking services tailored to meet the needs of individuals and businesses alike.

Whether you’re a resident or an expatriate, SCB is committed to providing top-notch financial solutions and excellent customer service.

What is ไทยพาณิชย์ (Siam Commercial Bank)?

Siam Commercial Bank, often called SCB, is a central commercial bank in Thailand. It offers a comprehensive suite of financial services, including personal and business banking, investment management, and digital banking solutions. With a strong reputation and a commitment to innovation, SCB has become a trusted name in the Thai banking industry.

Importance of SCB in the Thai Banking Industry

SCB plays a pivotal role in the Thai banking sector. It is known for its robust financial products, customer-centric services, and contributions to economic growth. SCB’s innovative approach to banking has set new standards in the industry, making it a key player in Thailand’s financial landscape.

History of ไทยพาณิชย์

Founding and Early Years

Siam Commercial Bank was established in 1906, making it one of the oldest banks in Thailand. It was founded by Prince Mahisorn, a member of the Thai royal family, with the vision of modernizing Thailand’s banking system and supporting its economic development.

Significant Milestones in SCB’s Development

Over the years, SCB has achieved numerous milestones, including introducing pioneering banking technologies, expanding its branch network, and launching innovative financial products. These milestones have helped SCB maintain its position as a leader in the Thai banking industry.

Mission and Vision of ไทยพาณิชย์

SCB’s Core Mission

SCB’s mission is to provide comprehensive financial solutions that enhance the lives of its customers and contribute to Thailand’s economic growth. The bank is committed to excellence, innovation, and customer satisfaction.

Vision for the Future

Looking ahead, SCB aims to continue its legacy of innovation and customer-centric services. The bank envisions a future where it remains at the forefront of the banking industry, leveraging technology to offer seamless and secure financial solutions.

Organizational Structure

Leadership Team

SCB’s leadership team comprises experienced professionals who drive the bank’s success. The team includes executives, directors, and advisors who bring a wealth of knowledge and expertise to the organization.

Key Departments and Their Roles

SCB is structured into various departments, each focusing on different aspects of banking, such as retail banking, corporate banking, investment management, and digital banking. These departments work together to deliver comprehensive financial services to SCB’s customers.

Financial Products and Services

Personal Banking Services

SCB offers various personal banking services, including savings and checking accounts, personal loans, credit cards, and mortgage solutions. These services are designed to meet the diverse needs of individual customers.

Business Banking Solutions

SCB provides tailored financial solutions for businesses for businesses, including business loans, corporate accounts, trade finance, and cash management services. These products help companies to manage their finances efficiently and support their growth.

Investment and Wealth Management

SCB’s investment and wealth management services cater to customers looking to grow their wealth. The bank offers investment advisory, portfolio management, and financial planning services to help clients achieve their financial goals.

Digital Banking Innovations

SCB Easy App Features

The SCB Easy app is a state-of-the-art mobile banking platform that offers a range of features, including account management, fund transfers, bill payments, and investment tracking. The app provides a convenient and secure way for customers to manage their finances.

Online Banking Services

SCB’s online banking services allow customers to access their accounts, transfer funds, pay bills, and apply for loans from the comfort of their homes. The online platform is user-friendly and secure, ensuring a seamless banking experience.

Future Tech Innovations

SCB is continuously exploring new technologies to enhance its digital banking services. The bank invests in AI, blockchain, and fintech solutions to offer cutting-edge financial products and improve customer experience.

Customer Experience and Support

Customer Service Excellence

SCB is committed to providing excellent customer service. The bank offers multiple channels for customer support, including phone, email, and live chat. SCB’s customer service team is dedicated to resolving inquiries and issues promptly.

Branch and ATM Network

SCB has an extensive network of branches and ATMs across Thailand. This ensures that customers have easy access to banking services, whether they are in urban or rural areas.

SCB’s Customer Loyalty Programs

SCB offers various loyalty programs to reward its customers. These programs include exclusive offers, discounts, and reward points that can be redeemed for different products and services.

Corporate Social Responsibility

Community Engagement Initiatives

SCB is actively involved in community engagement initiatives. To give back to the community, the bank supports various social programs, including education, healthcare, and disaster relief efforts.

Environmental Sustainability Efforts

SCB is committed to environmental sustainability. The bank has implemented green banking practices and supports initiatives that promote environmental conservation and sustainability.

Educational Programs and Scholarships

SCB offers educational programs and scholarships to support the development of young talent. These initiatives help students pursue higher education and develop the skills needed for their careers.

SCB’s Role in Thailand’s Economy

Supporting Local Businesses

SCB plays a crucial role in supporting local businesses. The bank provides financial solutions and advisory services that help businesses grow and thrive, contributing to Thailand’s overall economic development.

Contributions to Economic Growth

SCB contributes to Thailand’s economic growth through its financial products and services through its financial products and services. The bank supports infrastructure projects, trade finance, and investment initiatives that drive economic development.

Financial Inclusion Initiatives

SCB is dedicated to promoting financial inclusion. The bank offers products and services catering to underserved communities, ensuring everyone has access to essential banking services.

SCB’s International Presence

Overseas Branches and Partnerships

SCB has established a strong international presence with branches and partnerships worldwide. This allows the bank to support Thai businesses and expatriates abroad, facilitating global trade and investment.

Services for Expatriates and International Businesses

SCB offers specialized services for expatriates and international businesses, including cross-border banking, foreign exchange, and global trade finance. These services help clients manage their finances and operations seamlessly.

Security and Privacy Measures

Data Protection Policies

SCB takes data protection seriously. The bank has implemented robust data protection policies and practices to safeguard customer information and ensure privacy.

Fraud Prevention Strategies

SCB employs advanced fraud detection and prevention strategies to protect customers from fraud to protect customers from fraud. The bank continuously monitors transactions and uses sophisticated security measures to prevent fraud.

Future Prospects for ไทยพาณิชย์

Strategic Goals for the Coming Years

SCB has set ambitious strategic goals for the coming years. These include expanding its digital banking services, enhancing customer experience, and driving sustainable growth.

Upcoming Projects and Initiatives

SCB has several exciting projects and initiatives in the pipeline. These include launching new financial products, investing in technology, and expanding its international presence.

How to Open an Account with SCB

Step-by-Step Account Opening Process

Opening an account with SCB is straightforward. Customers can visit a branch or apply online by providing the required documents and completing the necessary forms.

Required Documents and Eligibility

To open an SCB account, customers must have identification documents, proof of address, and other relevant information. The bank offers different account types to suit various needs and eligibility criteria.

FAQs about ไทยพาณิชย์

1. What services does SCB offer for businesses?

SCB offers a range of business services, including business loans, corporate accounts, trade finance, and cash management solutions.

2. How can I access SCB’s digital banking services?

SCB’s digital banking services are accessible through the SCB Easy app or the bank’s online banking platform.

3. Does SCB offer financial planning services?

SCB offers financial planning and investment advisory services to help customers achieve their financial goals.

4. What are the benefits of SCB’s loyalty programs?

SCB’s loyalty programs offer exclusive rewards, discounts, and points that can be redeemed for various products and services.

5. How does SCB support sustainability?

SCB supports sustainability through green banking practices, environmental conservation initiatives, and the promotion of sustainable business practices.

Contact Information

For more information or to contact SCB, you can visit their website or contact their customer service. SCB has branches across Thailand and international offices to serve customers worldwide.

The Comprehensive Guide to SCB: Exploring the Swedish Chamber of Commerce for the UK

Introduction to SCB

The Swedish Chamber of Commerce for the UK (SCB) is a dynamic organization that fosters business relationships and trade between Sweden and the United Kingdom.

In today’s interconnected world, chambers of commerce like SCB are crucial in bridging gaps between businesses across borders, providing invaluable support, resources, and networking opportunities.

What is SCB?

SCB is a prominent bilateral chamber of commerce that serves as a vital link between Swedish and UK businesses. It aims to support and promote the interests of its members by providing a platform for networking, advocacy, and business development.

Importance of SCB in the Global Business Landscape

In the global business landscape, chambers of commerce like SCB facilitate international trade and investment. They provide businesses with the tools and resources to navigate complex international markets, foster economic growth, and enhance bilateral relations.

History of SCB

Founding and Early Years

The Swedish Chamber of Commerce for the UK was established to enhance trade relations between Sweden and the UK. From its early years, SCB has focused on providing robust support to its members, facilitating trade, and creating a solid network of business leaders.

Key Milestones in SCB’s Development

Over the years, SCB has achieved several key milestones, including establishing initiatives, launching business programs, and hosting high-profile events. These milestones have solidified SCB’s position as Europe’s leading chamber of commerce.

Mission and Vision of SCB

SCB’s Core Mission

SCB’s core mission is to promote, support, and develop business relations between Sweden and the UK. This involves providing members with essential resources, fostering a strong business community, and advocating for policies that facilitate trade and investment.

Vision for the Future

SCB envisions a future where it continues to be the go-to organization for businesses looking to establish and grow their presence in Sweden and the UK. This includes expanding its network, enhancing its services, and driving forward-thinking initiatives.

Organizational Structure

Leadership Team

SCB’s leadership team comprises experienced professionals dedicated to advancing the chamber’s mission. The team includes executives, board members, and advisors who bring a wealth of knowledge and expertise to the organization.

Departments and Their Functions

SCB is structured into various departments, each focusing on different aspects of the chamber’s operations, such as membership services, events, advocacy, and business support. These departments work together to deliver comprehensive support to SCB’s members.

Membership Benefits

Networking Opportunities

One of the primary benefits of joining SCB is access to a vast network of business professionals. Members can attend events, join discussion groups, and connect with peers and potential partners, fostering valuable relationships.

Access to Resources and Information

SCB provides members access to various resources, including market reports, business guides, and industry insights. This information is crucial for making informed business decisions and predicting market trends.

Discounts and Exclusive Offers

Members also enjoy discounts on various services and products and exclusive offers from partner organizations. These benefits can result in significant cost savings and added value for member businesses.

Events and Programs

Annual Events Hosted by SCB

SCB hosts annual events, including business forums, networking receptions, and gala dinners. These events allow members to engage with industry leaders, share knowledge, and celebrate successes.

Training and Development Programs

SCB offers training and development programs to support its members’ professional growth to support its members’ professional growth. These programs cover various topics, from leadership skills to industry-specific knowledge, helping members stay competitive.

Industry-Specific Conferences

SCB organizes industry-specific conferences that bring together experts and stakeholders from various sectors. These conferences provide a platform for discussing trends, challenges, and opportunities and fostering collaboration.

Business Support Services

Advisory Services

SCB offers advisory services to help members navigate the complexities of international trade. These services include business consultations, market entry strategies, and regulatory guidance.

Market Research Assistance

Understanding the market is critical to success in international business. SCB provides members with market research assistance, offering insights into market conditions, consumer behaviour, and competitive landscapes.

Export and Import Support

SCB supports members in their export and import activities by guiding logistics, customs regulations, and trade compliance. This support helps businesses streamline their operations and reduce risks.

SCB’s Role in International Trade

Promoting Trade Between Sweden and the UK

SCB plays a pivotal role in promoting trade between Sweden and the UK. The chamber facilitates trade missions, business delegations, and trade fairs, helping businesses explore new opportunities and expand their reach.

Key Trade Initiatives and Partnerships

SCB has established several key trade initiatives and partnerships to enhance trade relations. These include collaborative projects with government agencies, trade organizations, and private sector partners.

Success Stories

Case Studies of Successful Collaborations

SCB has facilitated numerous successful collaborations between Swedish and UK businesses. These case studies highlight the positive impact of SCB’s support and the potential for growth and success through international partnerships.

Testimonials from Members

SCB members often share testimonials about their experiences and successes. These stories testify to the value of SCB membership and the benefits of being part of a supportive business community.

Advocacy and Policy Influence

SCB’s Involvement in Policy-Making

SCB actively engages in policy-making processes to advocate for business-friendly policies. The chamber represents the interests of its members, working with government bodies and policymakers to influence regulations and create a favourable business environment.

Key Advocacy Campaigns

SCB has launched several advocacy campaigns on issues critical to its members. These campaigns address trade policy, economic development, and regulatory reform, aiming to drive positive change.

Sustainability Initiatives

SCB’s Commitment to Sustainability

SCB is committed to promoting sustainability in business practices. The chamber encourages members to adopt environmentally friendly practices and supports initiatives that contribute to sustainable development.

Green Business Programs and Awards

SCB runs green business programs and awards to recognize and celebrate businesses that firmly commit to sustainability. These programs highlight best practices and inspire others to follow suit.

Educational Resources

Webinars and Online Courses

SCB offers a variety of educational resources, including webinars and online courses. These resources cover various topics, from business strategy to industry trends, providing valuable learning opportunities for members.

Publications and Research Papers

In addition to online courses, SCB publishes research papers and industry reports. These publications provide in-depth analysis and insights, helping members stay informed and make strategic decisions.

Young Professionals Network

Programs for Young Professionals

SCB’s Young Professionals Network offers programs to support the next generation of business leaders. These programs include mentorship opportunities, networking events, and leadership development workshops.

Mentorship Opportunities

Through its mentorship program, SCB connects young professionals with experienced mentors. These relationships provide guidance, support, and valuable career advice, helping young professionals navigate their career paths.

SCB in the Media

Press Releases and News Coverage

SCB regularly issues press releases and receives news coverage for its activities and initiatives. This media presence helps raise awareness of SCB’s work and highlights its ‘ successesmembers’ successes.

Media Partnerships

SCB collaborates with media partners to promote its events and initiatives. These partnerships extend SCB’s reach and provide additional exposure for its activities and member businesses.

Future Prospects for SCB

Strategic Goals for the Coming Years

Looking to the future, SCB has set strategic goals to enhance its services, expand its membership, and increase its impact. These goals include developing new programs, strengthening partnerships, and fostering innovation.

Upcoming Projects and Initiatives

SCB has several exciting projects and initiatives in the pipeline. These include new business support services, expanded educational programs, and innovative sustainability initiatives.

How to Join SCB

Membership Application Process

Joining SCB is straightforward. Prospective members can apply online through the SCB website, providing information about their business and their membership goals.

Membership Tiers and Fees

SCB offers various membership tiers, each with its benefits and fees. Prospective members can choose the tier that best suits their needs and budget, ensuring they receive the most value from their membership.

FAQs about SCB

1. What is the mission of SCB?

SCB’s mission is to promote, support, and develop business relations between Sweden and the UK by providing resources, networking opportunities, and advocacy for its members.

2. How can I become a member of SCB?

You can become a member by applying online through the SCB website. Choose the membership tier that fits your needs and complete the application process.

3. What benefits do SCB members receive?

SCB members receive numerous benefits, including access to networking events, business support services, educational resources, and discounts on products and services.

4. Does SCB offer support for young professionals?

SCB offers a Young Professionals Network that provides mentorship opportunities, leadership development programs, and networking events.

5. How does SCB promote sustainability?

SCB promotes sustainability through its green business programs, awards, and advocacy for environmentally friendly business practices.

Contact Information

For more information or to contact SCB, you can visit their website or contact their offices. SCB has locations in both Sweden and the UK, making it accessible to businesses in both countries.

The Ultimate Guide to Rownavigator.com: Navigating the Seas of Rowing Excellence

Are you a rowing enthusiast looking for a comprehensive resource to elevate your game?

Look no further than Rownavigator.com.

This website is a treasure trove of information and tools designed to help rowers of all levels improve their skills and knowledge.

Whether a beginner or a seasoned pro, Rownavigator.com offers everything you need to succeed on the water or in the gym.

What is Rownavigator.com?

Rownavigator.com is an online platform dedicated to all things rowing. It provides a wealth of resources, including articles, guides, tutorials, and community forums, all aimed at helping rowers enhance their performance and enjoyment of the sport.

Importance of Rowing in Fitness and Recreation

Rowing is not just a competitive sport; it is also a fantastic form of exercise that offers numerous health benefits. It engages multiple muscle groups, improves cardiovascular health, and provides a low-impact workout suitable for all ages. With the rising popularity of rowing as both a fitness activity and a recreational pursuit, having a go-to resource like Rownavigator.com is invaluable.

History of Rownavigator.com

Founding and Evolution

Rownavigator.com was founded by a group of passionate rowers who recognized the need for a centralized hub of rowing information. Over the years, the site has evolved to incorporate many features and services, becoming a trusted resource in the rowing community.

Milestones and Achievements

Since its inception, Rownavigator.com has reached several significant milestones, including partnerships with major rowing organizations, the launch of a premium membership program, and a vibrant online community.

Features of Rownavigator.com

User-Friendly Interface

One of Rownavigator.com’s standout features is its user-friendly interface. The website is easy to navigate, with clear categories and an intuitive layout that makes finding information a breeze.

Comprehensive Rowing Resources

From beginner tips to advanced techniques, Rownavigator.com covers all aspects of rowing. The site features detailed articles, instructional videos, and interactive tools to help users improve their rowing skills.

Rowing Techniques and Tips

Basic Rowing Techniques

If you are new to rowing, mastering the basics is essential. Rownavigator.com provides step-by-step guides on fundamental rowing techniques, including proper form, stroke mechanics, and breathing techniques.

Advanced Rowing Strategies

For more experienced rowers, the site offers advanced strategies to enhance performance. Learn how to optimize stroke efficiency, increase endurance, and improve race tactics.

Common Mistakes to Avoid

Even seasoned rowers can fall into bad habits. Rownavigator.com highlights common rowing mistakes and offers practical advice on correcting them, ensuring you get the most out of your workouts.

Rowing Equipment Guide

Types of Rowing Machines

Rowing machines come in various styles, each with its advantages. Rownavigator.com provides an in-depth look at different types of rowing machines, including air, magnetic, and water rowers, helping you choose the best one for your needs.

Maintenance Tips for Rowing Equipment

Proper maintenance of your rowing equipment is crucial for longevity and performance. The site offers tips on caring for your rowing machine, from regular cleaning to troubleshooting common issues.

Health Benefits of Rowing

Physical Benefits

Rowing is a full-body workout that targets multiple muscle groups, including the legs, back, arms, and core. It also enhances cardiovascular health, improves flexibility, and promotes weight loss.

Mental Benefits

Rowing offers physical and mental health advantages. Its rhythmic nature can be meditative, reducing stress and promoting well-being.

Rowing for Different Age Groups

Rowing for Children and Teens

Rowing is an excellent activity for young people, helping them develop physical fitness, teamwork skills, and discipline. Rownavigator.com guides children and teens in introducing them to the sport safely and effectively.

Rowing for Adults

For adults, rowing offers a balanced workout that can be adjusted to fit various fitness levels. The site includes tips on incorporating rowing into a busy lifestyle and achieving fitness goals.

Rowing for Seniors

Rowing is particularly beneficial for seniors. It offers a low-impact exercise option that supports cardiovascular health and maintains muscle strength. Rownavigator.com provides advice on how seniors can start rowing and enjoy its benefits.

Rownavigator.com Community

Forums and Discussion Boards

One of ‘s highlightsRownavigator.com’s highlights is its active community. The forums and discussion boards allow users to connect with fellow rowers, share experiences, and seek advice.

Success Stories and Testimonials

Reading about others’ successes can be incredibly motivating. Rownavigator.com features testimonials and success stories from users who have achieved their rowing goals with its help.

Rowing Workouts and Training Plans

Beginner Rowing Workouts

If you are starting, Rownavigator.com offers beginner-friendly workouts that build a solid foundation. These plans focus on developing basic rowing skills and improving overall fitness.

Intermediate Training Plans

For those ready to take their rowing to the next level, intermediate training plans provide a structured approach to increasing intensity and endurance. These workouts are designed to challenge and progress your abilities.

Advanced Rowing Regimens

Advanced regimens that focus on peak performance can benefit experienced rowers. These plans include high-intensity intervals, endurance sessions, and race preparation strategies.

Nutrition for Rowers

Pre-Workout Nutrition

What you eat before a rowing session can significantly impact your performance. Rownavigator.com offers nutrition tips for fueling your body with the proper nutrients before hitting the water or the gym.

Post-Workout Recovery Foods

Recovery is just as important as the workout itself. The site provides advice on post-workout nutrition to help your body repair and rebuild, ensuring you are ready for your next rowing session.

Rowing Competitions and Events

Local and International Rowing Events

Rownavigator.com keeps you updated on upcoming rowing competitions and events, both locally and internationally. Whether you are a spectator or a participant, you will find valuable information on how to get involved.

How to Prepare for Competitions

Preparing for a rowing competition requires careful planning and training. The site offers tips on how to get competition-ready, from training schedules to mental preparation techniques.

Rownavigator.com Membership Benefits

Free vs. Premium Membership

Rownavigator.com offers both free and premium membership options. Free members can access a wealth of primary resources, while premium members enjoy exclusive content, advanced tools, and personalized support.

Exclusive Content and Perks

Premium members benefit from various perks, including access to in-depth articles, expert advice, and special discounts on rowing equipment and events.

How to Get Started with Rownavigator.com

Creating an Account

Getting started with Rownavigator.com is simple. The site provides a step-by-step guide on creating an account and all the available resources.

Navigating the Website

Once you have created an account, navigating the website is straightforward. The user-friendly interface makes finding the information you need, from training tips to community forums, accessible.

FAQs about Rownavigator.com

1. Is Rownavigator.com suitable for beginners?

Yes, Rownavigator.com is designed for rowers of all levels, including beginners. The site offers various resources to help new rowers get started.

2. Can I access Rownavigator.com on my mobile device?

Rownavigator.com is mobile-friendly, allowing you to access its resources on the go.

3. Are there any membership fees for Rownavigator.com?

While Rownavigator.com offers a free membership option, a premium membership offers additional benefits and exclusive content for a fee.

4. How can I join the Rownavigator.com community?

You can join the community by creating an account on the website and participating in the forums and discussion boards.

5. Does Rownavigator.com offer personal coaching?

Yes, premium members can access personalized coaching and expert advice to help them achieve their rowing goals.

Conclusion

Rownavigator.com is an invaluable resource for anyone interested in rowing, from beginners to seasoned athletes.

With comprehensive guides, community support, and expert advice, the site provides everything you need to excel in rowing.

Whether you want to improve your technique, find the best equipment, or connect with fellow rowers, Rownavigator.com has you covered. Dive in today and start your journey towards rowing excellence!

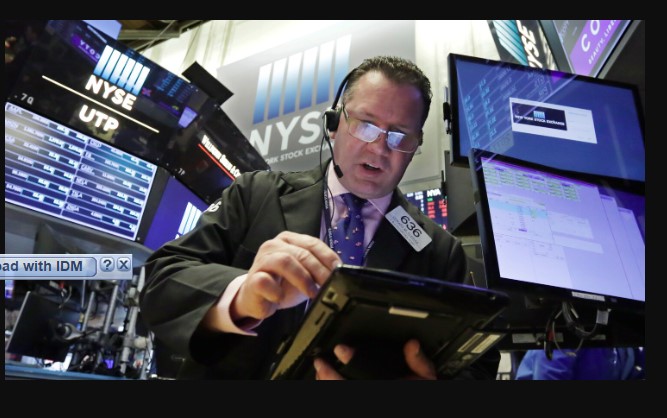

Dow Jones FintechZoom Insights – Your Essential Guide

In today’s fast-paced financial world, staying informed with accurate and timely information is crucial for investors and financial professionals.

Dow Jones FintechZoom Insights offers a comprehensive resource for understanding the dynamics of the financial markets, mainly focusing on fintech developments.

This guide will provide an in-depth look at Dow Jones FintechZoom Insights, its key features, and how it can benefit users.

What is Dow Jones FintechZoom Insights?

Dow Jones FintechZoom Insights is a leading financial news and analysis platform that provides real-time data, expert analysis, and the latest news on financial markets, mainly focusing on fintech.

Leveraging Dow Jones’s trusted reputation, the platform aims to equip users with the insights to make informed investment decisions.

Key Features

Real-Time Market Data

One of the standout features of Dow Jones FintechZoom Insights is its provision of real-time market data:

- Stock Prices: Instant access to the latest stock prices for major indices, including the Dow Jones Industrial Average, NASDAQ, and S&P 500.

- Market Trends: Detailed information on market trends and movements, helping users understand the broader market context.

- Economic Indicators: Key economic indicators such as GDP, unemployment rates, and inflation data.

In-Depth Analysis

Dow Jones FintechZoom Insights offers a comprehensive analysis of various financial topics:

- Market Analysis: Expert analysis of market trends, investment strategies, and economic forecasts.

- Sector Reports: Detailed reports on technology, healthcare, and finance sectors.

- Investment Research: In-depth research reports on individual stocks, bonds, and other investment vehicles.

Expert Opinions

The platform features insights and opinions from leading financial experts:

- Analyst Reports: Reports and recommendations from top analysts.

- Interviews: Exclusive interviews with industry leaders and financial experts.

- Editorials: Opinion pieces on market trends and investment strategies.

Fintech News and Updates

Stay updated with the latest developments in the fintech industry:

- Breaking News: Real-time updates on fintech companies, technologies, and innovations.

- Regulatory Changes: Information on regulatory changes affecting the fintech sector.

- Startup Spotlights: Features on emerging fintech startups and their potential impact on the market.

Benefits of Using Dow Jones FintechZoom Insights

- Accurate Information: Access to reliable and accurate financial data and news.

- Timely Updates: Real-time updates ensure users stay informed about the latest market developments.

- Expert Analysis: Insights from industry experts help users make informed investment decisions.

- Comprehensive Coverage: Coverage of a wide range of financial topics, from stock markets to fintech innovations.

- User-Friendly Interface: An easy-to-navigate platform that makes finding information quick and efficient.

Pros and Cons

Pros

- Reputable Source: Trusted information from Dow Jones.

- Real-Time Data: Instant access to market data and news.

- Expert Insights: Analysis and opinions from financial experts.

- Extensive Coverage: Comprehensive coverage of financial markets and fintech.

Cons

- Subscription Costs: Some features may require a paid subscription.

- Complexity: The vast amount of information may be overwhelming for novice users.

- Internet Dependence: Requires a stable internet connection for real-time updates.

Conclusion

Dow Jones FintechZoom Insights is an invaluable resource for anyone involved in the financial markets. From real-time market data and in-depth analysis to expert opinions and the latest fintech news, the platform provides everything users need to stay informed and make strategic investment decisions.

While some considerations regarding subscription costs and complexity exist, the benefits far outweigh these concerns, making it a go-to resource for financial professionals and investors alike.

FAQs

Q1: What is Dow Jones FintechZoom Insights?

A: It is a financial news and analysis platform offering real-time market data, expert analysis, and the latest fintech news.

Q2: How can I access Dow Jones FintechZoom Insights?

A: You can access it through the official website or mobile app, with some features requiring a subscription.

Q3: What kind of data does Dow Jones FintechZoom Insights provide?

A: The platform provides stock prices, market trends, economic indicators, and in-depth analysis on various financial topics.

Q4: Who can benefit from using Dow Jones FintechZoom Insights?

A: Financial professionals, investors, and anyone interested in staying informed about financial markets and fintech developments.

Q5: Are there any costs associated with Dow Jones FintechZoom Insights?

A: While basic features may be free, access to premium content and detailed reports may require a paid subscription.